How To Link Your Aadhaar Card With Your PAN & Mobile Number: The government of India has made it mandatory for citizens to link their Aadhar card with their PAN card. This linking is essential to avail many central government services and can help prevent tax evasion and fraud. Linking your Aadhar card and mobile number can ease your income tax return filing and identity verification process for government schemes.

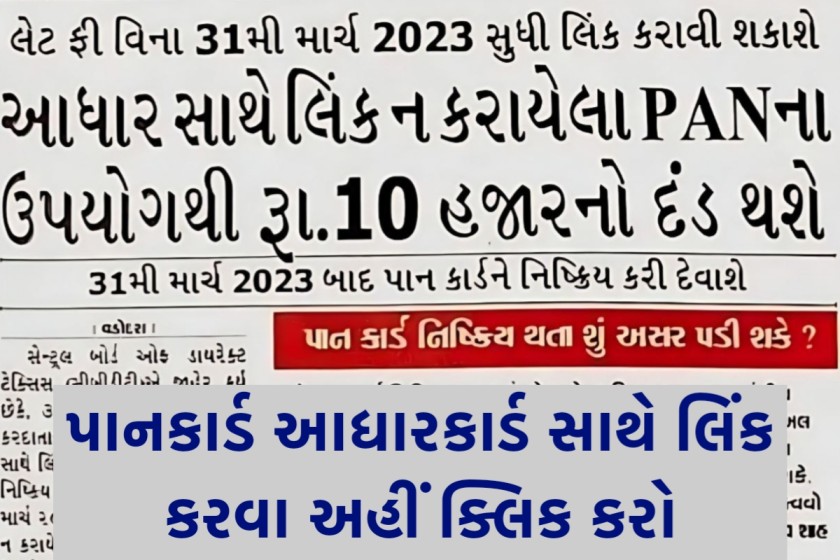

The deadline for linking your Aadhar card with your PAN card was March 31st, 2022, but it has now been extended to March 31st, 2023.

In this article, we’ll cover the steps you need to take to successfully complete the process for linking Aadhar with both PAN and mobile number.

How To Link Your Aadhaar Card With Your PAN & Mobile Number

How can I link my Aadhaar card with PAN online? PAN card link with Aadhar can be done entirely from your home. There are two ways through which linking can be done: by visiting the government e-filing website or by sending an SMS.

How to link Aadhaar with PAN card online step-by-step via SMS:

Step 1: Type UIDPAN<12-digit Aadhaar><10-digit PAN> on your smartphone messaging app.

Step 2: Send the SMS to 56161 or 567678.

You will receive a confirmation once the linking has been completed.

Here are the steps that need to be taken to link your Aadhar card with your PAN card through e-filing website:

- Step 1: Go to https://eportal.incometax.gov.in/iec/foservices/#/pre-login/bl-link-aadhaar, the government portal for filing income tax.

- Step 2: You will find a “Quick Links” option on the website. Under this option, you need to click on “Link Aadhar”.

- Step 3: You will be asked to provide your Aadhar number, PAN card number, and full name.

- Step 4: You will be asked to confirm whether you want your Aadhar card to be validated by checking the box.

- Step 5: You will need to fill in the relevant Captcha to prove that you’re a human.

That’s all you need to do to link your Aadhar and PAN card numbers.

Next, we’ll talk about how to link your Aadhar card with your mobile number.

How can I link my Aadhar card with mobile number at home?

This process cannot be completed online, and you will need to go to your nearest Aadhar office to link your phone number with your Aadhar card. This is because the process requires bio-metric verification which can only be done in person.

The steps involved are as follows:

- Step 1: Visit your nearest Aadhar card office or telecom operator branch.

- Step 2: Provide your mobile number to the executive.

- Step 3: You will receive a one-time password (OTP) on your mobile number.

- Step 4: Provide this OTP to the executive.

- Step 5: Provide your fingerprint for biometric validation.

That’s all. You will receive a confirmation once the linking process has been completed.

If you think you may have already linked your mobile number with your Aadhar card but not sure about it, then you can check the status of your linking.

You can check the status of linking between your mobile number and your Aadhar card through the following steps:

- Go to https://uidai.gov.in/ which is the UIDAI’s official website.

- Click on MyAadhar which is a button located at the top left corner.

- Click on “Verify Mobile Number” button after clicking on MyAadhar.

- Provide the information that you’re being asked such as your mobile number, card number, etc.

Once you’ve passed the Captcha verification, the website will confirm whether your mobile number has been linked to your Aadhar or not.

Benefits of Linking Your Aadhaar with PAN

Aadhaar and PAN card are both unique ID cards that can be used for identity verification on their own. The linking of these two provides the following added benefits:

- Stops the misuse of government benefits and subsidies by individuals claiming multiple PANs

- Easier process of income tax return filing through e-verification.

- Helps in the detection and prevention of tax evasion for the income tax department.